Talk:Income tax

| This It is of interest to the following WikiProjects: | |||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||

|

| A fact from this article was featured on Wikipedia's Main Page in the On this day section on August 5, 2004, August 5, 2005, and August 5, 2006. |

Adam Smith advocating income tax?

[edit]I don't know why this article says that Adam Smith supported income tax in generalized way, putting him at the pair of Marx (although Adam Smith might advocate income tax in very particular cases). In his book (avalable online) it says:

- Adam Smith, "The Weath of Nations", book V 2.133:

"If direct taxes upon the wages of labour have not always occasioned a proportionable rise in those wages, it is because they have generally occasioned a considerable fall in the demand for labour. The declension of industry, the decrease of employment for the poor, the diminution of the annual produce of the land and labour of the country, have generally been the effects of such taxes."

- "The Weath of Nations", book V.2.135:

"Absurd and destructive as such taxes are, however, they take place in many countries."

I will proceed to remove the reference to Adam Smith, leaving alone the citation of karl marx.

Also it would be good to discuss some criticism of income taxes in the article

Unsourced commentary moved to talk page

[edit]I moved the following commentary from the article to here:

- The US Supreme Court ruled that the 16th amendment conferred no new powers of taxation to the US government. Therefor, if the income tax was unconstitutional before the 16th, it was also after the 16th. Also, IRS Tax Code does not list the income as a mandatory tax which you are liable for, it is not listed in the table of taxes you are liable for, and there is not penalty listed for not paying it. It is actually a voulentary tax for individuals. If you have any doubt of this, read IRS form 1040 (the income tax filing form, and it lists the IRS tax code sections in the privacy statemet which are relevant to the income tax, then read the IRS tax code. Also, contact the IRS, a tax attorney, or your local political representative.)

Non-neutral, unverified. Stay tuned. Famspear 18:07, 6 December 2006 (UTC)

Post-script: Dear anonymous user at IP 75.72.81.229: The arguments in the above commentary, (which was posted by IP 75.72.81.229), have been covered over and over here in Wikipedia. Please read all talk (discussion) pages.

It is correct to say that the U.S. Supreme Court and other Federal courts have stated, over and over, that the Amendment conferred no new powers of taxation. However, the statement that "if income tax was unconstitutional before the 16th, it was also after the 16th" is, from a legal standpoint, nonsensical.

Regarding the IRS Tax Code, there is no such thing as a tax that is not "mandatory." There is no such thing as a "table of taxes you are liable for" -- taxes are not listed that way in the statute.

The whole voluntary - not voluntary argument has already been covered and explained.

The privacy statement in the Form 1040 instruction booklet is also irrelevant. Please read the relevant articles.

Contacting the IRS, a tax attorney, or your local political representative will almost surely yield the correct answer -- which is that the U.S. Federal income tax is constitutional and is being applied correctly.

Have a nice day. Famspear 18:22, 6 December 2006 (UTC)

- Post-post script: Rather than repeat all the reasons why the commentary by IP 75.72.81.229 is incorrect (aside from violating the Wikipedia guidelines of verifiability, neutral POV, and no original research), please refer to: Tax protester arguments; Tax protester constitutional arguments; Tax protester statutory arguments; Tax protester conspiracy arguments, and other tax-related Wikipedia articles. Yours, Famspear 19:20, 6 December 2006 (UTC)

It is utterly apparent your objection is not to the usage of words you sought criticism upon, but it’s substance. Your objection is Non-Neutral.

You gave no references in your objections. Please revise your objection.

Whoa! What a touch of subtlety to suggest sweeping it under the rug of “protestor conspiracy.” That's a bit of leap, my friend.

And no, it hasn’t been covered and explained. Tilde, Tilde, Ssauble 15:25, 8 February 2007 (UTC)

- This article is not the place to cover and explain it. Please see the articles referenced above by Famspear. Morphh (talk) 15:08, 9 February 2007 (UTC)

Way to be nonbiased!! (sarcastically speaking). If you are giving all of the details, then the law for income taxes should be explained in this article. Explain to us exactly how income taxes are Constitutional. If you cannot supply us with the law, than both sides should be covered and we shouldn't be refered to other articles. FFF 20:48, 22 March 2007

This is not true.

The often misquoted Brushaber case is what you stand on. however read it. It clearly tests the 16th and finds that it is void under all circumstances. 240 US 1 69.245.136.69 06:27, 13 August 2007 (UTC)

- Dear user at IP69.245.136.69: You are quite incorrect. The Court in Brushaber upheld the income tax. The Court did NOT "test the 16th [amendment]" and find that the amendment "is void." There is no such thing as a court of law finding a Constitutional amendment "void." YOU need to read the Brushaber case. The Court upheld the constitutionality of the Federal income tax in that case. Mr. Frank Brushaber LOST the case. The text is available for all to read on the internet at www.findlaw.com. This has been covered over and over and over again here in Wikipedia.

- There is no such thing as a court of law finding a constitutional amendment "void." The concept is legally nonsensical. Many tax protesters began attacking the Sixteenth Amendment, most of the cases beginning about 60 or 70 years after it was ratified. In every single case, the courts have upheld the amendment. Yours, Famspear 09:56, 13 August 2007 (UTC)

Archive

[edit]I have archived this talk page. GameKeeper 08:23, 24 January 2007 (UTC)

Image

[edit]This article needs a good image to stimulate interest. I have quickly knocked up a graph Image:Income Taxes By County.svg based on http://www.oecd.org/document/60/0,2340,en_2649_34533_1942460_1_1_1_1,00.html table 1.2. Average % income taxes by County.

If this is considered suitable I will make it prettier, ie add titles and labels keys. FYI the 4 bars for each county represent % income paid in taxation based of 67%,100%,133% and 167% of average income. I had used a stacked bar graph but unfortunately the Netherlands % income for 100% average wage is less than that of 67% average wage which could not be represented in this way. GameKeeper 10:01, 24 January 2007 (UTC)

- Nice! - I wonder if it is necessary to have all four bars though. Maybe we should just pick one like 100% and state it below the chart. As it is now, the image may be difficult to read due to size and this could help. We could add another bar based on table 11.1 (Corporate income taxes). Morphh (talk) 13:47, 24 January 2007 (UTC)

- I agree, 4 bars does look cluttered. 100% is the obvious choice to retain. I am not sure if adding a bar for corperation tax would make it look cluttered again. I'll try both soon. GameKeeper 10:53, 25 January 2007 (UTC)

- New version qith 2 bars one for corperate one for personal uploaded Image:Income Taxes By County.svg, you may need to refresh you browser to see new version. I like this more , cleaner and more relevant to income tax as it shows both types. If we are agreed about basic data and graph format I will clean it up next and add titles etc. GameKeeper 16:29, 26 January 2007 (UTC)

- This looks great! You got my vote. Morphh (talk) 16:57, 26 January 2007 (UTC)

- Thanks for the nudge. I have uploaded what I have got at present GameKeeper 20:12, 30 January 2007 (UTC)

- Unfortunately there seems to be a bug in it. Norway is not displayed until you zoom right into picture. I'll see if I can work out why and correct. Annoyingly the SVG works fine for me on my local machine GameKeeper 22:09, 30 January 2007 (UTC)

- Odd - Since your tweaking on it... See if you can get a tighter crop on it - looks like the right, left, and bottom have a bit of extra transparency and whitespace. Might also want to see what the title text would look like as one line (or perhaps two). The tighter you can make it, the larger the chart will look (and thus look better). Don't take that as a critique - I think the image looks great! Just figured since your tweaking it, we could see if these other changes might make it look that much better. Morphh (talk) 01:54, 31 January 2007 (UTC)

- I think I have cracked the Norway problem, I don't see it with firefox or IE anymore. Tightened the crop and put the title on a single line. Criticism is appreciated when it is constructive. GameKeeper 20:18, 4 February 2007 (UTC)

- I have a bone to pick with this graph. For most people this is not a very accurate reference on how much personal tax is paid per country. Based on what I know about tax rates in several European countries, this graph seemed completely wrong. It wasn't until I downloaded the excel spreadsheet that I realised the figures used are inclusive of Employer social security contributions and then it started to make sense. Perhaps there should be a note explaining how the figures are derived? Or even better, perhaps there should be a separate graph showing only the tax and SSC paid by the employee. --JamesTheNumberless 13:53, 14 March 2007 (UTC)

- Good point - I'll add this to the image caption. If we have a source that adds employer payroll tax contributions, this would be a good supplemental or replacement image. Morphh (talk) 14:59, 14 March 2007 (UTC)

- Morph you have it the wrong way round. The personnal income tax graph does include SSC payments (see the referenced data table 1.2 footnote). The reason for this is that it is a graph of 'income taxes' which are all taxes calulated on income. Many countries have a tax they call 'income tax' and in additon taxes that may be called different things, such as SSC contributions, these are still classified as income taxes. I have added a note to the graph and changed your note on the page. I don't think excluding the SSC payments would make this of more use, in my opinion this is just a method of disguising the total tax cost of employment. To have a good comparision to another country it should be included. GameKeeper 15:38, 14 March 2007 (UTC)

- Opps - I guess I should have taken a closer look at the data before making the change. Thanks. I had misunderstood the comment and I agree that the information should be included as it shows a more accurate tax burden. Morphh (talk) 16:38, 14 March 2007 (UTC)

- I agree that separating income tax from social security contributions would just lead to more confusion, however, I maintain that there is encyclopaedic value in showing the percentage paid by the employee against the percentage paid by the employer. In many countries, the employee pays far less tax than here in the UK, however, this is often because the employer is paying a lot more. Consequently this makes the UK business more competitive as it can offer higher gross salaries at the same actual cost of employment. --JamesTheNumberless 15:52, 15 March 2007 (UTC)

- I'm pretty sure it is generally accepted that employer portions of payroll taxes come directly out of would be salaries to employees. So I'm not sure the ratio would would make much difference, although the perception would be so. It is more a tax shuffle to hide the tax burden then anything. I don't disagree that such is important to specify. I think that distinction is discussed on the articles regarding those particular taxes. I'm sure we can find a place to briefly mention it in this article. Morphh (talk) 16:15, 15 March 2007 (UTC)

- Morph you have it the wrong way round. The personnal income tax graph does include SSC payments (see the referenced data table 1.2 footnote). The reason for this is that it is a graph of 'income taxes' which are all taxes calulated on income. Many countries have a tax they call 'income tax' and in additon taxes that may be called different things, such as SSC contributions, these are still classified as income taxes. I have added a note to the graph and changed your note on the page. I don't think excluding the SSC payments would make this of more use, in my opinion this is just a method of disguising the total tax cost of employment. To have a good comparision to another country it should be included. GameKeeper 15:38, 14 March 2007 (UTC)

- Good point - I'll add this to the image caption. If we have a source that adds employer payroll tax contributions, this would be a good supplemental or replacement image. Morphh (talk) 14:59, 14 March 2007 (UTC)

- I have a bone to pick with this graph. For most people this is not a very accurate reference on how much personal tax is paid per country. Based on what I know about tax rates in several European countries, this graph seemed completely wrong. It wasn't until I downloaded the excel spreadsheet that I realised the figures used are inclusive of Employer social security contributions and then it started to make sense. Perhaps there should be a note explaining how the figures are derived? Or even better, perhaps there should be a separate graph showing only the tax and SSC paid by the employee. --JamesTheNumberless 13:53, 14 March 2007 (UTC)

- I think I have cracked the Norway problem, I don't see it with firefox or IE anymore. Tightened the crop and put the title on a single line. Criticism is appreciated when it is constructive. GameKeeper 20:18, 4 February 2007 (UTC)

- Odd - Since your tweaking on it... See if you can get a tighter crop on it - looks like the right, left, and bottom have a bit of extra transparency and whitespace. Might also want to see what the title text would look like as one line (or perhaps two). The tighter you can make it, the larger the chart will look (and thus look better). Don't take that as a critique - I think the image looks great! Just figured since your tweaking it, we could see if these other changes might make it look that much better. Morphh (talk) 01:54, 31 January 2007 (UTC)

- Unfortunately there seems to be a bug in it. Norway is not displayed until you zoom right into picture. I'll see if I can work out why and correct. Annoyingly the SVG works fine for me on my local machine GameKeeper 22:09, 30 January 2007 (UTC)

- Thanks for the nudge. I have uploaded what I have got at present GameKeeper 20:12, 30 January 2007 (UTC)

- This looks great! You got my vote. Morphh (talk) 16:57, 26 January 2007 (UTC)

- New version qith 2 bars one for corperate one for personal uploaded Image:Income Taxes By County.svg, you may need to refresh you browser to see new version. I like this more , cleaner and more relevant to income tax as it shows both types. If we are agreed about basic data and graph format I will clean it up next and add titles etc. GameKeeper 16:29, 26 January 2007 (UTC)

- I agree, 4 bars does look cluttered. 100% is the obvious choice to retain. I am not sure if adding a bar for corperation tax would make it look cluttered again. I'll try both soon. GameKeeper 10:53, 25 January 2007 (UTC)

The title of the graph is misleading when it states "mean" tax rates. When reading the source for corporate tax rates it states "Where a progressive (as opposed to flat) rate structure applies, the top marginal rate is shown. —Preceding unsigned comment added by 209.98.116.10 (talk) 22:17, 19 September 2010 (UTC)

Criticism

[edit]This article needs a criticism section. Morphh (talk) 03:39, 25 January 2007 (UTC)

The reference links in the Critique section need to be updated. Three of the four links in this section are currently functional. Folklore1 (talk) 20:21, 5 August 2010 (UTC)

GA drive

[edit]I think this article was greatly improved during the Taxation Collaboration of the Month. I think if we take care of the tasks in the todo list, we should be good to submit this for Peer Review and then for GA. Morphh (talk) 20:53, 5 February 2007 (UTC)

- I had a go with an auto review tool. The results are here Talk:Income tax/autoPR GameKeeper 21:18, 5 February 2007 (UTC)

Paul Conners commentary

[edit]A user named Paul Conners has been repeatedly inserting the following material at the top of the article:

- This article is loaded up with all the predictable BULLSHIT that keeps many lawyers and accountants in business.

- The phrase "Income Tax" is a government promulgated semantical phrase which practically speaking means "Living Tax". "Income Tax" is a tax citizens pay for simply "maintaining their life by pursuing sustenance and shelter by having otherwise lawful employment". It is a clear assault on every American's supposedly unqualified "Right To Life". Yet "Income Tax" is somehow spoken of here in this article as if it was bestowed upon the American public by some spontaneous act of the creator. Where is it properly articulated that "income tax" is any different than "slavery by stealthy means"? This article speaks of "income tax" as a concept that has existed since the dawn of time. Why not just tax an American citizen for every heartbeat they have "Heartbeat Tax", or every breath they take "Breathing Tax"? It really is not that much different if you think about it. "Income Tax" is nothing but a "legalized" assault on the American citizens by the government. There are ways to finance necessary government services without taxing a citizens' pursuit of sustenance and shelter through lawful labor. But I guess those ways would not allow the government to weazel it's way into every nook and cranny of our lives. So those methods are not prefered by our power hungry government.

Verifiability, Neutral Point of View, No Original Research. Wikipedia is not a proper forum for venting your personal views. Please observe Wikipedia policies & guidelines. Yours, Famspear 04:33, 16 February 2007 (UTC)

- The user has been blocked from editing for 31 hours in accordance with Wikipedia's blocking policy as a result of the repeated abuse of editing privileges. Morphh (talk) 04:49, 16 February 2007 (UTC)

Karl Marx on income tax

[edit]I am removing the Karl Marx quote. It has been added to 'principles'. My reasons for doing so are: i) There is no particular connection between the fact that progressive income tax was mentioned by Marx and the principle of income tax or progressive income tax; ii) the previous text mentions that it was supported by economists of different ideologies, and it appears POV to mention only one of them; iii) Marx was far from the only economist or first economist to suggest progressive income tax, and hence no compelling reason to quote him over any other (or at least more substantiation needed); iv) regardless of the above, quoting Marx is similar to some usages of an (implied) ad hominem argument ("Marx supported income tax, and he was a communist. Are you a communist?"). Did Hitler support progressive income tax? I have no idea, but quoting one of the most controversial figures of the last 200 years (Marx) seems an attempt to establish guilt by association. Or to put another way, Lenin was an advocate of electricity grids - quoting him over, say, Edison on electric transmission is stealth POV. (Apologies if I have misused in any way the strict philosophical definition of ad hominem)--Gregalton 08:00, 21 March 2007 (UTC)

Update: another user deleted before I did, and I support his reasons (and conciseness in expressing them). Marx is not particularly relevant here, and it should be discussed on this talk page before being inserted again.--Gregalton 08:03, 21 March 2007 (UTC)

- I want to re-affirm the fact that I support your position. It seems that someone wants to give the impression that income tax is communistic - which is ironic when you consider the fact that communist states had no income taxes. -- Nikodemos 08:11, 21 March 2007 (UTC)

- i) The reason for the quote is that it shows support for the previous statement different ideologies. It is relevant and in context.

- ii) Agreed it would be better to supply more citations, or perhaps a direct citation of 'supported by economists of different ideologies', that is a reason to add not delete info.

- iii) Agreed. We have a quote from Marx here, better to replace than delete, if anyone can find a better one.

- iv) The argument "Marx supported income tax, and he was a communist. Are you a communist?" is just a bad argument. Guilt by association is a bad argument. there is no reason to remove text because it supports this argument when the itself argument is bad! GameKeeper 08:33, 21 March 2007 (UTC)

- I conclude, it would be best if another citation can be found, showing support by different ideologies, but until that time the Marx citation is better than none. I'll try to find a better citation later. GameKeeper 08:33, 21 March 2007 (UTC)

- Thanks for your comments, although I still disagree. My point on (iv) was that this is the implied/inferred argument. It is, of course, a bad argument: my point is that it will be read by some that Marx was the primary or an important advocate if that is the only quote; inclusion of a quote from Marx (particularly if alone) is POV, irrespective of the merits or deficiencies of Marx's analysis. A quote from, say, Kenneth Arrow would not have similar connotations, so I think this quote should stay off until it can be NPOV - in this specific case, deletion is better until more balanced quotes can be found. Until such time as there is a better quote to balance - or some compelling reason to quote Marx - please leave it off. Personally, I do not see the need to provide quotes at all; the statement that 'economists of different ideologies support' is neutral and non-controversial (and on your point (i), does not really need support, unless in the context of a longer section) - "dueling quotes" will be controversial.--Gregalton 08:53, 21 March 2007 (UTC)

- I agree with GameKeeper on this one. He was the father of a political philosophy. Such would not be dueling quotes if you added other significant political ideologies. A negative attitude toward communism, socialism, or Karl Marx is not inherent and instantly POV. I'd argue that many of the political philosophies of the western world are greatly influenced by Karl Marx's work and a hybrid of socialism / capitalism. I see your argument though - I'll look for others to include. Morphh (talk) 14:31, 21 March 2007 (UTC)

- Well, we can agree to disagree on this one - I think it is inherently POV for most people (although which POV is ambiguous, some would argue positive, some negative). I would propose deleting, however, on another basis: the quote does not demonstrate in any way that Karl Marx was a noted thinker on income tax, nor prominent in decisions to implement), simply that he supported/predicted it.--Gregalton 14:52, 21 March 2007 (UTC)

- The point, I believe, is that Marx is a highly polarizing figure. Very few people have a neutral opinion about Marx - the vast majority either strongly support or strongly oppose him. Thus, associating Marx with something (other than Marxism, of course) is very likely to generate a stealth POV. For another similar example, imagine what would happen if someone quoted the Bible in support of taxation (which can be done, by the way - I can find the relevant verse for you). -- Nikodemos 18:29, 21 March 2007 (UTC)

- I agree entirely with Nikodemos - there are few neutral opinions about Marx (not knowing which POV a reader will have does not mean it is NPOV). And I still see no compelling link between Marx and income tax other than that he mentioned it in a book of rather sweeping nature.--Gregalton 18:39, 21 March 2007 (UTC)

- This problem would no longer exist if we reworded or found an alternative. Immedidately after However, the idea of a progressive income tax has garnered support from economists and political scientists of many different ideologies. , something like :-

- Adam Smith supported a progressive income tax in the the Wealth of Nations and Karl Marx argued for it in the The Communist Manifesto

- citations for both of these can be lifted from Progressive tax, where the quotes exist too. It would be a bit excessive to include both quotes in this article. I think these two examples demonstate the breadth of support for progressive income tax which is what the article needs at that point. GameKeeper 19:12, 21 March 2007 (UTC)

- What? A quote from a red like Adam Smith ;) ? I think a line like you have proposed without the full quotes (just refs) is a lot more reasonable. I'd suggest the wording "ideologies, from Adam Smith in the Wealth of Nations to Karl Marx in the Communist Manifesto." Assuming the quotes are not too off. Thanks for the suggestion.--Gregalton 19:47, 21 March 2007 (UTC)

- I went ahead and made the edit. Thanks. -- Nikodemos 07:17, 22 March 2007 (UTC)

[[1]]

uk tax update

[edit]uk taxation needs updating re budget —The preceding unsigned comment was added by 212.159.16.219 (talk) 16:01, 23 March 2007 (UTC).

Canada - top marginal rate

[edit]The source I have found for top marginal rate in Canada [2] gives a top rate of 48.64%, not the 50% cited here. I will substitute unless there is a reference that supports what the text currently has ("many provinces have top marginal tax rates over 50%).--Gregalton 08:37, 28 March 2007 (UTC)

- I checked too. The reference cited is misleading, though. Ontario, for example, is described as having a top marginal tax rate of 11.16%. But there's actually a surtax on top of that, that maxes out at 20%+36% of the tax previously calculated; so that corresponds to a tax rate of 11.16 + (.2 + .36)*11.6 = 17.4%

- Ontario health insurance is an interesting problem as well. The price you pay is an increasing function of income, but it's stepped: if you plot dollars paid vs. income, then it's a bunch of plateaus, with steep lines connecting them. If your income falls on the steep line, then your marginal tax rate is very high, and then it drops again once you're on the plateau. God only knows why they did that; in any case, that payment maxes out, so it doesn't affect the top marginal tax rate. Our hypothetical high-earner is already paying the maximum, and the maximum doesn't change if he earns a dollar more.

- I changed it from "exceeds 50% in many provinces" to "approaches 50% in some provinces," which I think is true. 24.91.135.162 08:47, 22 April 2007 (UTC)

- To be clear, I mean the reference cited in the article. The reference that you cite here appears to account for the surtax correctly. —The preceding unsigned comment was added by 24.91.135.162 (talk) 08:50, 22 April 2007 (UTC).

Income tax: direct versus indirect

[edit]An anonymous user changed the intro to read that an income tax is a "direct tax." My reversion of this edit was inadvertently denoted as a "minor" edit, and it is not a minor edit. As explained in various Wikipedia articles, some income taxes (particularly in the United States) have been considered direct taxes and others have been considered indirect taxes. Further, the terms "direct tax" and "indirect tax" have more than one technical meaning (even within a given country). The direct-indirect dichotomy is very complex. Further, we probably should keep the article international in scope. So, I would argue that we do not want to categorically say that an income tax is either a direct tax or an indirect tax. The technical distinctions are already explained in detail in various relevant articles. Yours, Famspear 15:10, 15 April 2007 (UTC)

- Another editor re-inserted the link to the article on direct tax, so that this article incorrectly stated that an "income tax is a direct tax." I reverted. Saying that an income tax is a direct tax is like making the categorical statement that "a Chevrolet is a Lumina." Some Chevrolets are not Luminas. Indeed, some Chevrolets are not cars at all, but are trucks. The flat statement that an income tax is a "direct tax" could be correct only if all income taxes were direct taxes -- which they are not. Further, as already explained, the terms "direct tax" and "indirect tax" have more than one meaning, which may not only vary from one country to the next but also may vary within one country. To say that an income tax is a direct tax is not only incorrect, it is meaningless. Famspear 15:01, 17 April 2007 (UTC)

This topic is KEY and Critical to the Understanding of US Taxation, and its validity. I have posted on the talk page of Tax Protestor Consitutional Objections. But for purposes of clarification here, I protest that we continually permit on Wikipedia the missapplication of the term "income" in all of these discussions.

When quoting citizens or protestors or even many incorrect implications reguarding the intent of the law (IRC) we tolerate, even imply, the common sense use of the term, which carries the inherent right of trading labor for currancy. ( Which by definition, would be taxed ONLY by a direct and in the case of the US- an apportioned tax. )

We do this at our peril of ignoring the legal and case-law definition of "income" which, since the IRC IS law and been ruled constitutional, and since the 'Income-Tax' is NOT apportioned, must therefore be understood by the Constitution to be an excise tax, and therefore predisposed to being optional under some priviledged activity that the citizen is engaging in.

This missapplication has its roots in the huge plethora of case law that correctly upholds the constitutionality of the IRC while offending our common sensibilities. The reason for this is in the underlying wordsmithing of the legal term "income" and its case law tested in court as far back as 1894. The frequently miss interpreted 16th ammendment does not, as many suppose, introduce the term 'income' for the first time, but instead relies on the historical legal meanings which the term accumulated as far back as 1860, and makes 'clear' for those who are reading the Constitution, that income as understood by the courts was gain acquired by such optional activities as federal priviledge bestowed upon govermental workers or other legally taxible activities engaged in by choice, and not by right. This is all detailed with court references in the Tax Protester Talk Pages.

I look forward to hearing what you have to say on this topic, Famspear. You are, by far the most densely referenced editor on the subject of taxation, though you do seem to engage in a gentle pressure to ensure the status quo rather than inform everyone on all opinions being presented to date. Its just more of the same redirection away from the true issues I have mentioned in my post on Tax-Protesting-Constituional Issues. Namely the continued miss-use of the term "Income Tax". Which clearly applies to everyone...all the time, in as much as they have [Income], as self defined by the IRC as "gains, profits and income DERVIED from salaries, wages, or compensation of services provided". [Income] is "gains derived from something you inherently already posses". And this distinction needs to begin to be clarified in any US context Income Tax presented on the wiki.InstallerMan 15:01, 17 April 2007 (UTC)

Contradictions in the list with other articles

[edit]These four lists need attention to be synchronized:

- Flat tax adoption around the world

- Flat tax

- Income tax#Countries with no personal income tax

- Tax rates around the world

Discuss here Talk:Tax_rates_around_the_world#Contradictions_in_the_list_with_other_articles Alinor 18:46, 1 June 2007 (UTC)

Suggestion about "Critique of income tax" section.

[edit]The middle five paragraphs of the section advocating a tax on the gross incomes of corporations seem inappropriate to the article for several reasons and I believe they should be deleted/modified. They read to me as POV and/or Original Research. Even if the many [citation needed] fields were filled with legitimate sources, giving this theory five paragraphs in a section that contains only seven paragraphs, gives it undue weight. Even the last paragraph, which appears to critique the previous five, does little to mitigate this.

These paragraphs appear to me to be a fringe theory and perhaps should be removed or at least merely summed up in a paragraph or two. I have no personal expertise on this topic, only an interest, and I am a great admirer of Famspear and Morphh, as well as other contributors, so I of course bow to your expertise.

Thank you for your attention.

SunsHand 21:38, 13 July 2007 (UTC)

- Thanks! Good catch, and I have deleted that text. When you see something like this, be bold and edit it. If you edit that part (or other articles), the citation flags often have a date. If the date is older than a month or two, it's reasonable to delete as unverified. Welcome to Wikipedia.--Gregalton 05:00, 14 July 2007 (UTC)

- I agree with SunsHand and Gregalton; based on a quick read, the material appeared to be pretty much unsourced. Famspear 06:00, 14 July 2007 (UTC)

Thank you both. It was my first Wiki-post and I will be less hesitant in the future.

SunsHand 22:50, 16 July 2007 (UTC)

Income tax in Uruguay

[edit]Income tax is back in Uruguay, according to this page: http://www.ft.com/cms/s/d82c1f02-27fc-11dc-80da-000b5df10621.html Antipoeten 22:14, 7 August 2007 (UTC)

Dear user at IP82.95.194.23: Please stop adding tax protester material regarding "Tom Cryer" (for which there is a separate article) and repeatedly reverting other editors. The material you are inserting is false and, more importantly, is not neutral and not properly sourced.

Also, please explain your edits at the time you make them by providing a description in the edit summary box. You should also consider discussing your edits on this talk page or on the talk page for the Cryer article.

It appears that you have violated the 3 revert rule, which may be considered disruptive editing. Please review Wikipedia guidelines and strive to work for consensus with other editors. Yours, Famspear 17:51, 10 August 2007 (UTC)

- I have added another warning to the talk page for the user at IP82.95.194.23. Famspear 20:22, 10 August 2007 (UTC)

- Violation of edit warring rule and the 3 revert rule continues by user at IP82.95.194.23, with an eighth reversion (8th reversion occurred after posting of warning template on user's talk page -- technically, the third warning). User has now reverted four different editors in less than 12 hours, without making any response on talk pages or providing any explanation in edit summary boxes. Famspear 22:26, 10 August 2007 (UTC)

Comment(s) by editor :

The Memorandum

(Pdf - 109 pages); filed in support of his Motion to Dismiss Evasion Charges Filed against him in:

United States versus Tommy K. Cryer D.J. - case 06-50164-01

Case closed at July 11th 2007 and is a precedent setting case for others to come

Attorney Tom K. Cryer District Judge (Court Louisiana for 34 years)

Indepth Info : The Memorandum

Short Info : Video Tom K.Cryer

—Preceding unsigned comment added by 194.109.22.148 (talk • contribs) (on 12 August 2007)

- It's clearly not precedent-setting. It's a jury verdict. The court rejected all the tax protester arguments. If they had accepted one, that might be precedent-setting. — Arthur Rubin | (talk) 13:50, 26 August 2007 (UTC)

Dear IP208.65.153.251: I hate to be the one to break the news to you, but the only precedent set in the Cryer case was precedent against Cryer's tax protester arguments. That is documented in the article Tom Cryer. A jury verdict is not a "ruling" and therefore is not a "precedent." In fact, had the court ruled in Cryer's favor on his "legal" arguments, there would have been no "not guilty" verdict by the jury -- indeed, there would have been no jury verdict at all. The judge would have simply thrown the case out. Cryer ended up winning an acquittal -- but that was based on a jury verdict after the court ruled against Cryer on his arguments that "wages are not taxable," etc. The article on Cryer includes citations to the actual documents where the court ruled against Cryer, with the entry numbers on the court docket, dates, and case number. Famspear 14:33, 26 August 2007 (UTC)

Mister Famspear maybe you better look for a real job ? {{subst:82.95.194.23|21:15, 27 August 2007 (UTC)}}

- Dear anonymous editor at IP82.95.194.23: I already have a real job making big bucks. I notice that you are linking to the "synaptic sparks" web site, of all places. You will also notice that the operator of that web site tried to tangle with me about the meaning of the tax law in the spring of 2006. Here's what happened to him:

[3]. He has never responded to that post. Si tu n'es pas un avocat, evites un disputation avec un avocat au sujet de la loi. Famspear 21:37, 27 August 2007 (UTC)

Question of Income Tax Liability

[edit]Would someone mind telling me what law makes the average American liable for or subject to income tax for revenue purposes? If a supporting regulation exists, can you cite that too? Will you please provide reference links so I can read them for myself?

And will you please explain why the income tax page does not address the matter of substantive regulations, and laws that make normal folks liable for income taxes? That seems to me a critically important point to illuminate, particularly in the US income tax article.

--BobHurt 17:18, 28 August 2007 (UTC)

- I should first note that this article is about the general concept of an income tax and how income taxes are applied worldwide, not specifically about the income tax in the United States (see Income tax in the United States for U.S.-specific info). The reason this article does not address "substantive regulations" and the laws that impose income taxes is that adding that much detail for the 20 countries that are specifically addressed in this article would quickly make the article too large to use.

- The law that imposes the income tax on individuals in the U.S. is Sec. 1 of the Internal Revenue Code (26 U.S.C. § 1—click the "§ 1" link to go to the text of that law). The page at this link lists the regulations promulgated under Sec. 1, in addition to other regulations (the regulations under Section 1 on that page are §1.1-2, §1.1-3, §1.1(h)-1, and §1.1(i)-1t ).

- The article Income tax in the United States does address the law that makes "normal people" liable for income taxes: it mentions Sec. 1 right in the introductory paragraph. — Mateo SA (talk | contribs) 17:41, 28 August 2007 (UTC)

The Internal Revenue Code though is not a Law —Preceding unsigned comment added by 194.109.22.148 (talk) 10:59, 1 September 2007 (UTC)

- And the Earth is not a planet, right? The Internal Revenue Code is a statute enacted by Congress. Famspear 12:29, 1 September 2007 (UTC)

Earth is a planet but not al planets are Earth

IRS code could be lawful but eventually being lawful does not mean being The Law or Constitution —Preceding unsigned comment added by 82.95.194.23 (talk • contribs) (1 September 2007)

- I see your point, and am convinced: The Law being lawful eventually does not mean that Constitution is what Code being is.

- Thank you! — Mateo SA (talk | contribs) 15:41, 1 September 2007 (UTC)

- This section is not a comment against this article, and should be immediately removed, archived, or sent to another talk page.

- The anon's comments are totally wrong, as usual.

- — Arthur Rubin | (talk) 16:40, 1 September 2007 (UTC)

Editor Mateo SA and I have tried to humor these people, but I don't disagree with editor Arthur Rubin; we should keep this talk page on point. Famspear 16:43, 1 September 2007 (UTC)

sth from nothing

[edit]if you find an old gold bar and decide to keep it, what is suppoed to happen? —Preceding unsigned comment added by 212.51.122.24 (talk) 17:49, 6 January 2008 (UTC)

Commentary on critique

[edit]I attempted to make a change to the income tax article but it was undone. I might not have worded things exactly correct but the main emphasis I was trying to make was the disparity in taxation when it is done on a business versus on an individual.

To my knowledge there are no gross revenue taxes that apply to most businesses (I could be wrong here but think your run of the mill company). Yet individuals have to pay income tax on their gross revenue. This seems completely unfair as it does not allow for the deduction of expenses for existing like business have for existing. I think the income tax article should view the income tax in this frame.

One or more of you will probably say that that is a non-neutral POV on the income tax but the current view is not neutral either. It is an endorsement of the status quo that we have with the income tax. A POV that was framed many years ago and is so common place today that people see consider it as neutral rather than illegitimate.

I merely think that the income tax article should reflect this double standard and make it more pronounced so those who view this page will actually give some thought to the double standard rather than never think about the double standards of the status quo.

P.S. What is with the sourcing requirements? Maybe this is addresses somewhere else, I honestly haven't looked, but what is to stop me from publishing an ebook or a white paper on a web site and sourcing that versus just making a statement on a wikipedia page?

[Robert Francis IP 72.209.12.250] 15:58, 15 January 2008 (UTC)

- Dear editor: I'm the one who undid the commentary. Your commentary is good commentary ("good" in the sense that I happen to agree with it, of course). You are absolutely correct, if you're talking about the U.S. Federal income tax on compensation for personal services by an individual. There is essentially no deduction allowed for the individual's personal living expense (cost of food, cost of a place to live, cost of gasoline to get to work, that sort of thing). There are a few arguable exceptions to that general statement, but your basic critique is absolutely sound in my opinion.

- The problem with your commentary is that it appears to be just that -- your commentary -- and not a previously published critique from a reliable, third party.

- And, to answer your question about a self-published ebook, etc. -- yes, I have seen at least one editor simply copy and paste from his own web site. That tactic was shot down by other editors, as an improper attempt at an "end run" around the Wikipedia prohibition on "original research." I'll try to add some links to your own talk page on Original Research -- what it is and why it's prohibited. Stay tuned. Yours, Famspear (talk) 21:20, 15 January 2008 (UTC)

A request for comment has been opened on the general topic of tax protester theories, and whether the articles that address them are NPOV. bd2412 T 18:06, 23 January 2008 (UTC)

Talk:Tax protester/Request for comment reminder

[edit]Just a reminder that I have proposed to call for a conclusion to this discussion on tax protester rhetoric on February 6. If anyone has anything more to add to the discussion, speak now! bd2412 T 16:56, 3 February 2008 (UTC)

Bobhurt, BobHurt, and using the talk page as a "complaint against government"

[edit]Bobhurt and his sock puppet BobHurt have been blocked. See [4] and [5]

While of course everyone should assume WP:GOODFAITH, Bob has stated his only reason for posting these things was as a complaint against the government.

You can complaint [sic] against government (if you do it the right way) at Wikipedia. I have written lots of complaints at the US income tax discussion pages, and much of the content is still there.

Since this material was not WP:GOODFAITH, it ought be deleted. —Preceding unsigned comment added by 65.39.221.157 (talk) 20:21, 5 May 2008 (UTC)

Video + slides by Floyd Norris (NYT), ok to add to the External Links?

[edit]I was going to add this external link to the Income Tax article but after reading the guidelines I was unsure whether it would be proper... I decided to leave this note here so people with more knowledge on the subject could decide about adding it or not. Video and slides from Floyd Norris (The New York Times), on the history of US Income Tax —Preceding unsigned comment added by Gustavoexel (talk • contribs) 03:10, 12 August 2008 (UTC)

Need to improve tax comparison among countries

[edit]In the comparison chart of income tax and corporate tax, the average income tax for the US is shown to be around 28%. This under represents the amount of income/personal tax that is paid in the U.S. If you add in the SS taxes as well as state and local taxes then it would be a better comparison to the taxes of say, Sweden. One might also argue that the cost of health insurance be added to the overall tax figure since in many of the countries with higher taxes than the U.S (and lower for that matter), a person gets free health care (health care paid for by their taxes). I estimate that I pay just under 50% in fed/local/state/ss taxes in the U.S. If I added in my health care costs it would bring to something over 50%. Perhaps a more detailed view of what each country provides for their taxes (universities, health care, etc.) would make the comparisons more valid.

I look forward to seeing the continuing improvements. Halitun (talk) 18:16, 5 September 2008 (UTC)

The cost an individual pays in private health insurance should not be included in the amount they pay in taxes. That would be better left for an article that discusses what different countries' use tax revenue for. Beyond health care there are going to be thousands of different government expenses that are made in some countries, but not others. The other problem is individuals who purchase their own health insurance will pay more or less money for different insurance plans with different levels of coverage. Cwkimbro (talk) 09:51, 20 October 2008 (UTC)

- This data might be represented better in the Tax rates around the world article. As far as the countries, I think this article is a poor example of how to structure an article. We should not have a list of countries. We should just describe what income taxation is, the history, principals, examples, and discuss the particular praise and criticisms. I think we should remove all the country stuff (sections 3 & 5), which should be presented in their own articles like Taxation in the United States, Income taxes in the United States, or FICA. Morphh (talk) 19:40, 05 September 2008 (UTC)

I went ahead and removed all the country subsections - listed below if any content needs to be entered into the tax article for the country. Please see Tax rates around the world for links to the particular country tax articles. Morphh (talk) 1:28, 07 September 2008 (UTC)

Australia

[edit]Since 1942, income tax in Australia has been collected solely by the Federal Government, to the exclusion of the Australian States (see Constitutional basis of taxation in Australia). Australia uses a system of progressive taxation on personal income that is collected as a pay-as-you-go tax (known as PAYG), a flat rate tax on business income (company tax), and a property tax limited to realised capital gains. Australia’s income tax system contains a complex array of deductions and offsets, and is administered by the Australian Taxation Office.

Argentina

[edit]Income tax in Argentina is collected solely by the Federal Government, to the exclusion of the Argentine Provinces. Argentina uses a system of progressive taxation on personal income that is collected as a deferred tax, a flat rate tax on business income (company tax, 35%), and a property tax limited to realised capital gains. Argentina’s income tax system contains a complex array of deductions and offsets, and is administered by the Administración Federal de Ingresos Públicos (AFIP).

Canada

[edit]The income tax was first imposed in Canada in 1914 on both individuals and corporations, collected primarily by the Federal Government originally meant to finance Canada's involvement in World War I set at a rate of 4%. Tax collection agreements enable both the federal and provincial governments to levy income taxes through a single administration and collection agency, called the Canada Revenue Agency. The federal government collects personal income taxes on behalf of all provinces except Quebec and collects corporate income taxes on behalf of all provinces except Alberta and Quebec. Canada has a graduated tax system, whereby the percentage over the "more than" amount goes up....graduated from 15 - 29% (2008).[2] These rates, together with provincial income tax rates, federal and provincial surtaxes, and provincial health premium taxes (both also calculated based on income), serve to create a combined top marginal tax rate that can approach 50% in some provinces.

Denmark

[edit]The Danish income tax was introduced in 1903 and is now divided into state tax and local tax. The state tax is a progressive tax while the local tax is a flat tax.

The local tax varies from municipality to municipality. The highest local tax in 2007 is 26,71 % and the lowest is 20,14 %. Income below DKK 41,000 ($8,000) (2007-level, adjusted annually) is tax exempt.[3]

There are three income brackets for the state tax. In 2007 income from DKK 39,500 to DKK 272,600 is taxed at 5,48%, income from DKK 272,600 to DKK 327,200 is taxed at additionally 6% and income above DKK 327,200 is taxed at 15% on top.

All income originating from terms of employment or self-employment are levied a social contribution at 8% before income tax. This contribution is widely regarded as "gross tax". The highest total income tax is therefore 62,28%.

A number of deductions apply. The general rule is that the taxpayer is able to deduct his expenses in acquiring his taxable income. There are many exceptions to this rule though. Employees have very limited possibilities for tax deduction as it is assumed that the employer covers the expenses related to the employee's work. The employer will then be able to deduct most of these expenses from his own taxable income.

Danish tax examples - as of 2008:

If you have what is considered a very low income (150,000 DKK equal to 31,250 USD) - you pay approx. 31,500 DKK income tax.

(Approx. 21% of the full amount.)

If you have what is considered an average income (375.000 DKK equal to 78,125 USD) - you pay approx 131,000 DKK income tax...

(Approx. 34.7% of the full amount.)

France

[edit]The French income tax is a progressive tax, i.e. tax is an increasing piecewise linear continuous function of income (excluding various rebates etc.). This means that the amount of income earned up to a certain amount t1 is taxed at a rate r1, then the remaining money, up to a certain amount t2 is taxed at a rate r2, etc. The income tax (impôt sur le revenu): 16% of tax revenue. The tax on corporations: 12% of tax revenue.

The French Government has launched the Copernic tax project which unifies the tax paying process.

Germany

[edit]The German income tax is a progressive tax: income below the "existence minimum" (about 8000 EUR/year) is tax-free, higher income is taxed with a marginal tax rate running from 15 % up to 45 % (as of 2008). Additionally, earned income is subject to about 40 % of social insurance fees, half of it to be paid by the employer and the other half by the employee.

Guatemala

[edit]In Guatemala, the Superintendencia de Administracion Tributaria (SAT) levies tax on personal and corporate income.

Hong Kong

[edit]There are three income types earned in Hong Kong that are taxed, but they are not locally referred to as income taxes. Per Inland Revenue Ordinance Chapter 112 (IRO), these three types are classified into: Profit tax IRO section 14, Salaries tax IRO section 8, and Property tax IRO section 5.[4]

India

[edit]India has a three-tier tax structure, comprising the Union Government, the State Governments and the Urban/Rural Local Bodies[5]. The power to levy taxes and duties is distributed among the three tiers of Governments, in accordance with the provisions of the Indian Constitution. The main taxes/duties that the Union Government is empowered to levy are Income Tax (except tax on agricultural income, which the State Governments can levy), Customs duties, Central Excise and Sales Tax and Service Tax. The principal taxes levied by the State Governments are Sales Tax (tax on intra-State sale of goods), Stamp Duty (duty on transfer of property), State Excise (duty on manufacture of alcohol), Land Revenue (levy on land used for agricultural/non-agricultural purposes), Duty on Entertainment and Tax on Professions & Callings. The Local Bodies are empowered to levy tax on properties (buildings, etc.), Octroi (tax on entry of goods for use/consumption within areas of the Local Bodies), Tax on Markets and Tax/User Charges for utilities like water supply, drainage, etc.

Indonesia

[edit]The income tax in Indonesia is known as Pajak Penghasilan (PPh) and is considered to be a progressive tax. The rule governing this taxation is also called pph21.

Iran

[edit]The Islamic Republic of Iran has income taxes. The highest tax bracket on profits is 46.4%.

Italy

[edit]Refer to IRPEF (in Italian) for the Italian personal taxation system.

The Italian personal income tax is a progressive tax, i.e. tax is an increasing piecewise affine continuous function of income (excluding various rebates etc.). This means that the amount of income earned up to a certain amount t1 is taxed at a rate r1, then the remaining money, up to a certain amount t2 is taxed at a rate r2, etc.

Japan

[edit]Progressive taxation at the national level that ranges from 5% to 40%. Resident taxes are an additional 10%.[6]

Malta

[edit]Malta has a progressive individual income tax, ranging from 0% to 35%. For single computations, income up to €8,150 is tax free, income between €8,151 and €14,000 is taxed 15%, income between €14,001 and €19,000 is taxed 20% and income above €19,000 is taxed 35%. For joint computations, income up to €11,400 is tax free, income between €11,401 and €20,500 is taxed 15%, income between €20,501 and €28,000 is taxed 20% and income above €28,000 is taxed 35%.

Mexico

[edit]Mexico has an income tax called ISR (Impuesto Sobre la Renta) which is progressive and, from 2008 on, a second tax called IETU (Impuesto Empresarial de Tasa Única, meaning flat business tax) which is, as its name shows, a flat tax.

Netherlands

[edit]The Netherlands taxes income on personal income (wages, profits, social security); some business income; and savings and investments. The tax on personal income is progressive and casts a wide tax net over wages, profits, social security, and pensions. The tax is withheld from wages and can reach a marginal rate of 52%. As an example of the breadth of the tax net, value gains in owner-occupied homes are treated as personal income, even though those gains are not realized (i.e. do not equate to cash in hand). Interest can be deducted as a cost incurred in earning the income. The tax on business income is a flat tax of 25% and only applied to "substantial business interests", which are generally a shareholding of 5%. A flat tax is paid on savings and investments, even if the gain is not realized.

Peru

[edit]The income tax in Peru is collected by the Superintendencia Nacional de Administración Tributaria (SUNAT). This country uses a system of progressive taxation on personal income, and a flat rate tax on business income.

Poland

[edit]Poland has a progressive personal income tax.[7]. The first 3,013 złotys earned in the year are free of tax, then income lower than 43,405 złotys is taxed at 19%. Yearly earnings between 43,405 to 85,528 złotys incur 30% tax. Top personal income tax rate is paid on earnings above 85,528 Polish złotys (apprx. 26,000 euro) per year and is equal to 40%.

Russia

[edit]Taxation of corporate and personal income is distinctly different.

Russia imposes a flat tax of 13% on personal income of tax residents of Russia, including capital gains. Dividends received are taxed at source at 9%. Lottery winnings and bank interest in excess of going Central Bank rate are taxed at 35%. Capital gains on sales of real estate and securities owned for a period of at least 3 years are free from taxation. The law provides for a number of itemized deductions, notably home purchase deduction, available once in lifetime, and college cost deduction. Maximum cap on these deductions is set quite low: tax savings on a home purchase are limited to 130,000 roubles (US $5,600) for both spouses.

Current expenses (even related to business revenue), depreciation, losses on investments are not deductible, unless the individual taxpayer register himself as a private entrepreneur and maintains separate bookkeeping on his private and business operations.

Resident corporate taxpayers are generally taxed at 24% on their pre-tax profits. A small business (including registered individual entrepreneurs) may elect to be taxed under simplified system and, instead of regular profit and value added tax, pay a flat 6% on gross receipts or 18% on gross margin.

Non-residents (individual and corporate) are taxed at a flat rate of 30%, except dividends received - 15%. Bilateral tax treaties may reduce this rate to zero.

Singapore

[edit]Singapore has a progressive individual income tax,[8] with taxes ranging from 0% to 20% up to Year of Assessment 2007. The tax net includes employment income, dividends, interests, and rental incomes.[8] A range of deductions are available. Singapore also has an income tax on corporations.[9]

Spain

[edit]Refer to IRPF (in Spanish) for the Spanish personal taxation system.

Sweden

[edit]Sweden has a taxation system that combines a direct tax (paid by the employee) with an indirect tax (paid by the employer). In practice, the employer provides the state with both means of taxation, but the employee only sees the direct tax on his declaration form. The compilation of taxes that compose the final income tax (2003): tax on gross income from the employer: 32.82% (indirect, fixed), pension fee on gross income: 6.95% (indirect, fixed), municipal tax on gross income less pension tax and a base deduction: ~32% (direct, varies by municipality), state tax on gross income less pension tax and a base deduction: 0%, 20%, or 25% (direct, progressive).

United Kingdom

[edit]The British income tax system is progressive with a number of bands: 10% (only applies to savings income and from April 2008 does not apply to earnings), 20% basic rate on UK dividends, investment income and income from employment/self employment (was 22% until April 2008), and (in respect of the higher rate band and all income on certain trusts) 32.5% on UK dividends and 40% on other sources[10] There are also a number of untaxed allowances (such as the personal allowance) to which tax bands do not apply. The tax is an annual tax and is reimposed each year in the annual Finance Act. In addition, the UK has a National Insurance contribution based on income. Although effectively another form of income tax, credits for payments of this applied to the individual's record which, in turn, will impact on entitlement to welfare and (the level of) state pension payments. Rates are levied on the self employed, the employed, and their respective employers. The United Kingdom also imposes a corporation tax, charged on the profits and chargeable gains of companies. The main rate is 30%, which is levied on taxable income above GBP 1.5 million, but it will be reduced to 28% in April 2008. Income of £300,000 or less is taxed at 20%. Marginal reliefs exist between the £300,000 and £1,500,000 bands.[11]

Under the Scotland Act 1998 , the Scottish Parliament has the power to increase or reduce the basic rate of income tax by three pence in the pound, though not yet exercised.

United States

[edit]The United States imposes an income tax on individuals, corporations, trusts, and certain estates. This tax is imposed on the income event, such as the receipt of wages. Another example of an income event is the realization of a gain on the disposition of property; that is, the appreciation on the value of property is not taxed until that property is sold (i.e., when the gain is "realized").

The U.S. income tax was first proposed during the War of 1812, but was defeated.[12] In July 1861, the Congress passed a 3% tax on all net income above $600 a year (about USD 10,000 today). Income taxes were enacted at various times until 1894, but were not imposed after 1895 when an 1894 tax act was found to be unconstitutional. In response, the 16th Amendment was ratified in 1913.[12] Ratification has been unsuccessfully disputed by some tax protesters. Tax protesters have also made other arguments about the validity of the U.S. income tax, without success (see Tax protester arguments).

The top marginal tax rate in the U.S. was 67 to 73 percent from 1917 to 1921, then began to fall, reaching a low of 25 percent from 1925 to 1931. The rate was increased to 63 percent in 1932, to 79 percent in 1936, and to 88 percent in 1942. From 1951 to 1963, the top marginal tax rate was 91 percent, and was 70 percent through most of the 1970s. In 1988 it was lowered to 28 percent, but raised in 1993 to 39.6 percent. The rate was lowered to 38.6 percent in 2001 and again lowered to 35 percent in 2003.

The 2007 individual federal income tax rates are between 10% and 35%, depending on income and family status. People with relatively low incomes may pay no income tax, or may receive earned income tax credits (tax benefits); however, this does not include income-based payroll taxes that fund Social Security and Medicare. As of 2004, three-fourths of taxpayers paid more in payroll taxes than they do in income taxes.[13] IRS data indicate that the wealthiest 5% of taxpayers (ranked by Adjusted Gross Income (AGI), counting only returns with positive AGI) paid roughly 60% of all income taxes; the bottom 50% of taxpayers account for just 3% of income taxes paid.[14]

U.S. state

[edit]Income tax may also be levied by individual U.S. states in addition to the federal income tax. Some states also allow individual cities to impose an additional income tax. Most state and local taxes are deductible expenses for federal tax purposes. Not all states levy an income tax (see State income tax)

Countries with no personal income tax

[edit]|

|

|

|

Manipulative graphics

[edit]The world maps with red and green colours don't look very NPOV but seems to suggest that low income taxes are good and high income taxes bad. IMHO another colour scheme would be preferable to the present one. —Preceding unsigned comment added by 217.229.20.166 (talk) 14:19, 28 October 2008 (UTC)

I don't know that I'd go so far to say that that is manipulative. It's even hard to justify that as POV since it's a POV that one color is bad in the first place. But I've removed them anyway since they are unsourced and there are problems with the data used to construct them. A question on the talk page of one regarding the data went unanswered and it's a very valid question. They are however exactly what the article should have, but they should be replaced by something scrupulously sourced. - Taxman Talk 13:34, 15 November 2008 (UTC)

References

- ^ "OECD Tax Database". Organisation for Economic Co-operation and Development. Retrieved 2007-01-30.

- ^ "What are the income tax rates in Canada for 2008?". Canada Revenue Agency. 2008-06-30. Retrieved 2008-07-31.

- ^ "Tax.dk". Spies Information. Retrieved 2008-01-05.

- ^ "The Hong Kong Ordinances". Bilingual Laws Information System. Retrieved 2007-01-24.

- ^ "Taxation in India". Retrieved 2008-04-05.

- ^ "Taxes in Japan". Retrieved 2007-09-05.

- ^ "Taxes in Poland". Retrieved 2007-07-30.

- ^ a b "Individual Income Tax". Inland Revenue Authority of Singapore. Retrieved 2007-01-24.

- ^ "Corporate Tax". Inland Revenue Authority of Singapore. Retrieved 2007-01-24.

- ^ "Rates and Allowances - Income Tax". HM Revenue & Customs. Retrieved 2007-01-24.

- ^ "HM Revenue & Customs: PN 02".

- ^ a b Cite error: The named reference

firstUSwas invoked but never defined (see the help page). - ^ Kamin, David (2004-09-13). "Studies Shed New Light on Effects of Administration's Tax Cuts". Center on Budget and Policy Priorities. Retrieved 2006-07-23.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ IRS Statistics of Income Division. "Tables 5 and 6, Individual Income Tax Rates and Tax Shares". Internal Revenue Service.

discrepancy to resolve

[edit]While bouncing around articles on taxes, I came across a discrepancy. This article, under the section History, says:

The first United States income tax was imposed in July 1861, 3% of all incomes over 600 dollars (later rescinded in 1872).

However, in the article Income Tax in the United States, section Early Federal Taxes, this is given:

In order to help pay for its war effort in the American Civil War, the United States government imposed its first personal income tax, on August 5, 1861, as part of the Revenue Act of 1861 (3% of all incomes over US $800; rescinded in 1872).

The first shows a figure of $600, the second a figure of $800.

I note that this article gives a source, Young, Adam (2004-09-07). "The Origin of the Income Tax". Ludwig von Mises Institute. http://mises.org/story/1597. Retrieved on 2007-01-24, while Income Tax in the United States does not, so my first inclination was to change the figure in that article to match this one. Erring on the side of caution, however, I decided to toss it up here for someone who might have the time to discover a second source to corroborate the first, and/or discover where the $800 figure came from.

Dismalscholar (talk) 18:09, 5 February 2009 (UTC)

- OK, I checked this. The correct amount is $800, not $600. It appears that section 49 of the Revenue Act of 1861, Ch. XLV (chapter 45), 12 Stat. 292, 309 (Aug. 5, 1861), provides:

- [ . . . ]That, from and after the first day of January next, there shall be levied, collected and paid, upon the annual income of every person residing in the United States, whether such income is derived from any kind of property, or from any profession, trade, employment, or vocation carried on in the United States or elsewhere, or from any other source whatever, if such annual income exceeds the sum of eight hundred dollars, a tax of three per centum on the amount of such excess above eight hundred dollars [ . . . ]

- --See volume 12, United States Statutes at Large, page 309. Yours, Famspear (talk) 22:27, 5 February 2009 (UTC)

I made a few more minor corrections. The income tax imposed in 1861 was expressly repealed by section 89 of the 1862 Act. Sections 86 and 90 of the 1862 Act imposed income taxes, though. Famspear (talk) 23:14, 5 February 2009 (UTC)

If there is a 'critique' section surely there should be a 'justifications' section too for the sake of balance?

[edit]The very existence of a 'critique' section without any section than explains the justifications given for imposing income tax seems in itself to be POV by exclusion. Perhaps we should add a section that briefly describes the various arguments given for the imposition and maintenance of income tax? —Preceding unsigned comment added by 116.227.85.134 (talk) 14:19, 27 May 2009 (UTC)

"Repayment" ?

[edit]Currently "Payroll" section includes: "These withholdings contribute to repayment of an employee's personal income tax obligation". Why "repayment"? If anything, shouldn't it be "prepayment"? Peter Delmonte (talk) 06:07, 7 February 2010 (UTC)

Thanks. Edited for clarity. Famspear (talk) 13:43, 7 February 2010 (UTC)

History

[edit]I saw Al Gore on a youtube video saying that Bismarck introduced the "tax on jobs" and we should replace it with green taxes instead - is that referring to income tax? So was Bismarck the one who introduced the first modern progressive income tax system? Wikidea 08:56, 24 April 2010 (UTC)

US-specific graphs used to illustrate an example

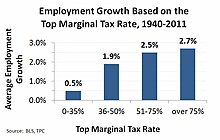

[edit]

I inserted these three graphs to illustrate the discussion on progressive income tax because they show the wide range of rates in the U.S., the wide history of the U.S's top rate, and the progressive effects of the top rate. There are no other graphs in this article at present, just a map. The graphs were removed with an edit summary "All relate to _income tax in the US_; we would need additional sources for relevance." Per WP:OI I do not believe we need any further sources for the obvious fact that these graphs illustrate the subject being discussed. The fact that they relate to the US is true and orthoginal to the fact that they illustrate the subject being discussed in the text adjacent to them. So I am replacing them. —Cupco 08:03, 25 September 2012 (UTC)

- I have to agree with Arthur Rubin. I'm finding it difficult to relate all of them to the section, particularly with the U.S. focus (see Wikipedia:Systemic bias). I can see the first image, but the caption fails to convey the relevance and meaning to the topic. So let's say I'm from the U.K. - what does "Marginal and average income tax rates in the US for 2009." mean to me as related to the "Principles of taxation" - the caption should convey what is being demonstrated as related to the content. Taking that to the next two, I'm not sure what the top marginal U.S. income tax rates or the average annual growth in U.S. employment has to do with that section. Morphh (talk) 13:12, 25 September 2012 (UTC)

- I think of systemic bias as more like writing which describes the U.S. without referring to it. We have a lot of that. When you use the US as an example, and it's clearly labeled as the US and not the world in general, that may tend to be provincialism but it's not bias. The text that these graphs are next to describe the variation of progressive tax rates and the arguments over their effects. The CBO recently commented on the same effect ("higher tax rates for the wealthy are statistically associated with higher levels of growth"). —Cupco 19:22, 25 September 2012 (UTC)

The last two of these graphs were removed again because "This is not a U.S. article and provides little relevance to 'Principles of taxes' ... two editors have disagreed with this content. They are shown as an example in the English Wikipedia because the U.S. is the largest primarily English-speaking country, and there are no international income taxes. Why are the graphs not relevant? Are there other graphs which would be more relevant? —Cupco 20:41, 3 October 2012 (UTC)

- I'm OK with using the U.S. as an example (as we did with the first image) if the images actually demonstrated the "Principles of taxes", but the last two don't. The section discussed the tax net, tax progressivity, pay-as-you-earn, tax refunds, and tax theory (Adam Smith, Frank Chodorov). What does that have to do with "Top marginal U.S. income tax rates from 1913 to 2011" and "Average annual growth in U.S. employment, by top income tax bracket rate, 1940–2011"? This section is discussing principles - what principle do they demonstrate? We're not discussing tax rates through history. We're not discussing annual growth (which this graph is easily both WP:POV and WP:SYN). I think one picture is sufficient for the section, but a picture of Adam Smith would be much more relevant to the topic and better than the two additional ones presented. Morphh (talk) 21:44, 3 October 2012 (UTC)

- This is not an article about the principles of income tax, it's an article about income tax, and it's supposed to be WP:COMPREHENSIVE. But let's say that it were only about principles. How is a general attribute such as the top bracket rate and the historical outcomes not part of the principles of income tax? —Cupco 01:23, 4 October 2012 (UTC)

See also entries

[edit]The section violates WP:SEEALSO, as most are also in {{See also}} links at the top of sections of the body. Also, many of those connect to [[Taxation in country]], when they should link to [[Income tax in country]] or [[Taxation in country#Income tax]]. — Arthur Rubin (talk) 16:24, 18 November 2012 (UTC)

Overhaul, re-rate

[edit]I have substantially expanded the article, other than the history parts. Prior to this expansion, the article was a start class article, meeting almost none of the criteria for C class let alone its B rating. The expanded version is, I believe, at least up to C class, and I have so rated it.

Edits are welcome. This article gets lots of hits, and probably was leaving readers far more frustrated than informed. Let’s try to get it to B class. Frankly, that will take a lot of additional work, and my time is limited. Oldtaxguy (talk) 01:12, 29 August 2013 (UTC)

External links modified

[edit]Hello fellow Wikipedians,

I have just modified 5 external links on Income tax. Please take a moment to review my edit. If you have any questions, or need the bot to ignore the links, or the page altogether, please visit this simple FaQ for additional information. I made the following changes:

- Added archive http://web.archive.org/web/20100724033906/http://www.hmrc.gov.uk/history/taxhis1.htm to http://www.hmrc.gov.uk/history/taxhis1.htm

- Added archive http://web.archive.org/web/20121025173841/http://www.deloitte.com/assets/Dcom-Global/Local%20Assets/Documents/Tax/Taxation%20and%20Investment%20Guides/2012/dttl_tax_highlight_2012_France.pdf to http://www.deloitte.com/assets/Dcom-Global/Local%20Assets/Documents/Tax/Taxation%20and%20Investment%20Guides/2012/dttl_tax_highlight_2012_France.pdf

- Added archive http://web.archive.org/web/20130603162133/http://www.fullermoney.com/content/2012-07-17/dttl_tax_highlight_2012_Singapore.pdf to http://www.fullermoney.com/content/2012-07-17/dttl_tax_highlight_2012_Singapore.pdf

- Added archive http://web.archive.org/web/20121025173846/http://www.deloitte.com/assets/Dcom-Global/Local%20Assets/Documents/Tax/Taxation%20and%20Investment%20Guides/2012/dttl_tax_highlight_2012_Brunei.pdf to http://www.deloitte.com/assets/Dcom-Global/Local%20Assets/Documents/Tax/Taxation%20and%20Investment%20Guides/2012/dttl_tax_highlight_2012_Brunei.pdf

- Added archive https://web.archive.org/20100125144548/http://www.oecd.org:80/document/60/0,2340,en_2649_34533_1942460_1_1_1_1,00.html to http://www.oecd.org/document/60/0,2340,en_2649_34533_1942460_1_1_1_1,00.html

When you have finished reviewing my changes, please set the checked parameter below to true or failed to let others know (documentation at {{Sourcecheck}}).

This message was posted before February 2018. After February 2018, "External links modified" talk page sections are no longer generated or monitored by InternetArchiveBot. No special action is required regarding these talk page notices, other than regular verification using the archive tool instructions below. Editors have permission to delete these "External links modified" talk page sections if they want to de-clutter talk pages, but see the RfC before doing mass systematic removals. This message is updated dynamically through the template {{source check}} (last update: 5 June 2024).

- If you have discovered URLs which were erroneously considered dead by the bot, you can report them with this tool.

- If you found an error with any archives or the URLs themselves, you can fix them with this tool.

Cheers.—InternetArchiveBot (Report bug) 07:16, 21 July 2016 (UTC)

"Modern Era" Section

[edit]It looks that there are typos or stuff to fix. Socialistguy (talk) 17:35, 29 November 2016 (UTC)

External links modified

[edit]Hello fellow Wikipedians,

I have just modified one external link on Income tax. Please take a moment to review my edit. If you have any questions, or need the bot to ignore the links, or the page altogether, please visit this simple FaQ for additional information. I made the following changes:

- Added archive https://web.archive.org/web/20140415064736/http://www-personal.umich.edu/~makotoh/research_files/Japan_disclosure.pdf to http://www-personal.umich.edu/~makotoh/research_files/Japan_disclosure.pdf

When you have finished reviewing my changes, you may follow the instructions on the template below to fix any issues with the URLs.

This message was posted before February 2018. After February 2018, "External links modified" talk page sections are no longer generated or monitored by InternetArchiveBot. No special action is required regarding these talk page notices, other than regular verification using the archive tool instructions below. Editors have permission to delete these "External links modified" talk page sections if they want to de-clutter talk pages, but see the RfC before doing mass systematic removals. This message is updated dynamically through the template {{source check}} (last update: 5 June 2024).

- If you have discovered URLs which were erroneously considered dead by the bot, you can report them with this tool.

- If you found an error with any archives or the URLs themselves, you can fix them with this tool.

Cheers.—InternetArchiveBot (Report bug) 15:41, 22 December 2017 (UTC)

return-free filing? (ie. government does your taxes)

[edit]Wikipedia doesn't seem to have an article about "return-free filing". If it doesn't, why not? In 1985, Ronald Reagan said "We call it the return-free system". ReadyReturn is about a version in 2005 and says "More than 20 other countries implement pre-populated returns for some of their taxpayers." And there is a section in TurboTax article: TurboTax#Opposition_to_return-free_filing. --EarthFurst (talk) 09:28, 6 July 2020 (UTC)

Income tax

[edit]About income tax 49.37.136.7 (talk) 03:39, 10 September 2022 (UTC)

- B-Class vital articles

- Wikipedia level-4 vital articles

- Wikipedia vital articles in Society and social sciences

- B-Class level-4 vital articles